You will need to complete this form before you start to receive payments from a new Employer – in this case, from your employer.

Make sure you provide the correct information, as the wrong information may lead to incorrect amounts of tax being withheld from payments made to you.

Follow Me.

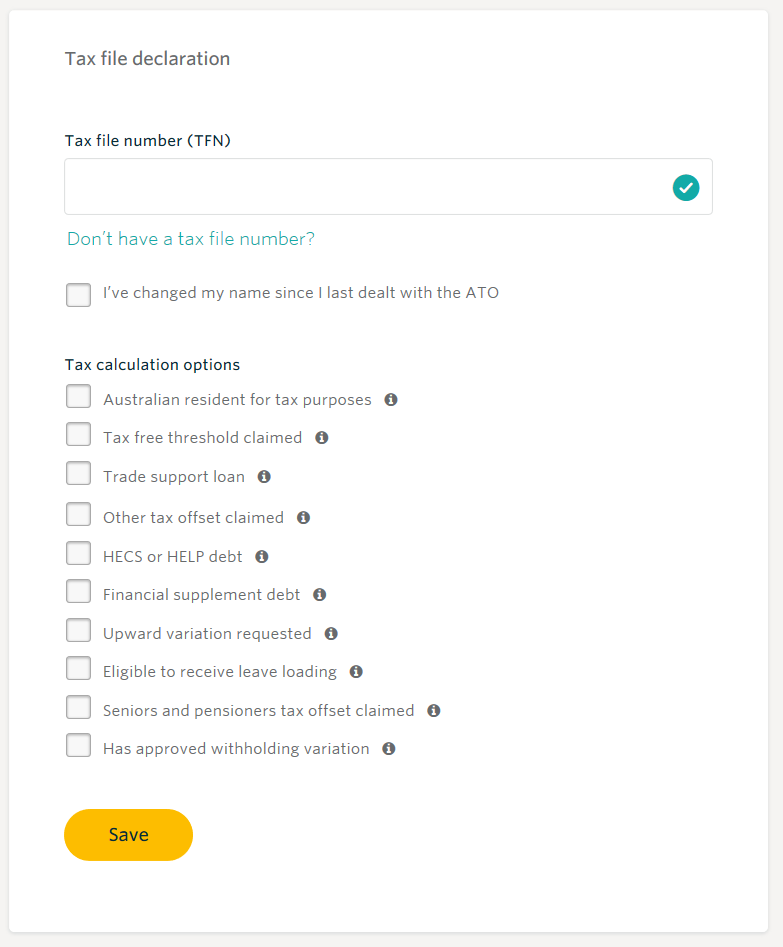

By default, Flare sets all employees to an Australian resident for tax purposes who claims the tax free threshold. If this is not correct in your circumstances uncheck the box that says "Australian resident for tax purposes". Make sure to select any Tax calculation option that applies to you.

For information on the Tax calculation options click the  icon next to the option. You can also read more about what each option means here.

icon next to the option. You can also read more about what each option means here.

Your tax file number (TFN) is your personal reference number in the tax and super systems.

You don’t have to have a TFN, but without one you pay more tax. You also won’t be able to apply for government benefits, lodge your tax return electronically or get an Australian business number (ABN).

If you are claiming an exemption from quoting your TFN, select “Don’t have a tax file number?” option:

Then select the reason as per the example below:

For more information about your TFN, such as how to apply for one or how to find yours, click here.

For more information about Tax calculation options, click here